What Is Foreclosure?

Foreclosure is the legal process by which a lender repossesses a property from a homeowner who has failed to make their mortgage payments. When a homeowner falls behind on their mortgage payments, the lender has the right to take possession of the property in order to recoup the money owed. Foreclosure can be a daunting and stressful process for homeowners, but it's important to understand the steps involved in order to navigate it effectively.

Common Reasons Foreclosure Happens

There are a variety of reasons why foreclosure may occur. Some common reasons include job loss, unexpected medical expenses, divorce, or simply being unable to afford the mortgage payments. Whatever the reason, it's important for homeowners to be proactive in addressing their financial difficulties in order to avoid foreclosure. Seeking help from a financial advisor or housing counselor can provide valuable guidance and resources for homeowners facing foreclosure.

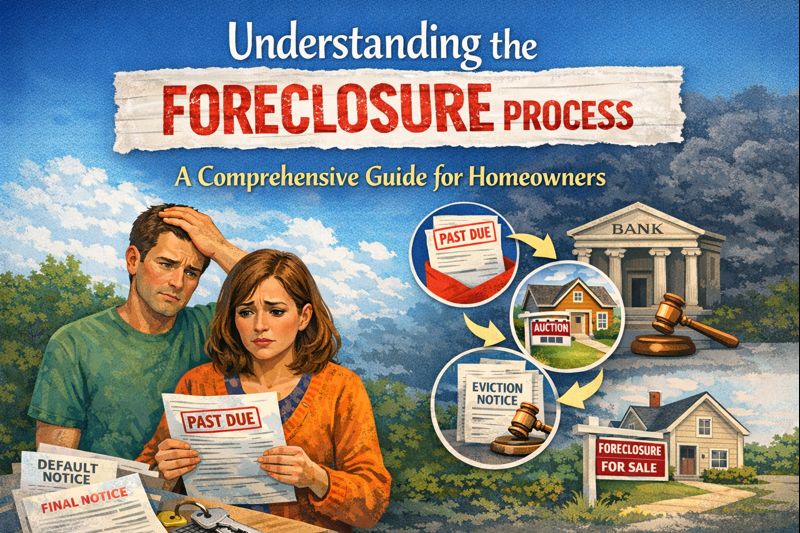

The Foreclosure Process: Step by Step

Missed Mortgage Payments: The foreclosure process typically begins when a homeowner misses one or more mortgage payments. It's important for homeowners to communicate with their lender as soon as they realize they are unable to make a payment in order to explore potential solutions.

Notice of Default: If a homeowner continues to miss payments, the lender will send a Notice of Default, informing the homeowner that they are in danger of foreclosure. This is a critical time for homeowners to take action and explore their options for avoiding foreclosure.

Pre-Foreclosure Period: During this period, homeowners have the opportunity to work with their lender to find a solution to avoid foreclosure. Options may include loan modification, forbearance, repayment plans, or selling the property through a short sale.

Foreclosure Filing: If a resolution is not reached during the pre-foreclosure period, the lender will file a foreclosure lawsuit against the homeowner. This initiates the legal process of foreclosure and sets a timeline for the sale of the property.

Foreclosure Sale or Auction: The property will be sold at a foreclosure sale or auction, typically to the highest bidder. The proceeds from the sale will be used to pay off the remaining balance on the mortgage.

Eviction: If the homeowner does not vacate the property voluntarily after the foreclosure sale, the lender may proceed with an eviction to remove the homeowner from the property.

Your Options to Avoid Foreclosure

There are several options available to homeowners facing foreclosure. These include:

Loan Modification: A loan modification involves changing the terms of the mortgage in order to make it more affordable for the homeowner. This may include lowering the interest rate, extending the term of the loan, or reducing the principal balance.

Forbearance: Forbearance allows homeowners to temporarily pause or reduce their mortgage payments while they address their financial difficulties. This can provide homeowners with the breathing room they need to get back on track.

Repayment Plan: A repayment plan involves making additional payments on top of the regular mortgage payments in order to catch up on missed payments. This can help homeowners get current on their mortgage and avoid foreclosure.

Short Sale: A short sale involves selling the property for less than the remaining balance on the mortgage. While this will result in a loss for the lender, it can help homeowners avoid foreclosure and move on from their financial difficulties.

Deed in Lieu of Foreclosure: A deed in lieu of foreclosure involves voluntarily transferring ownership of the property to the lender in order to avoid foreclosure. This can be a viable option for homeowners who are unable to sell the property through a short sale.

The Impact of Foreclosure on Credit

Foreclosure can have a significant impact on a homeowner's credit score. A foreclosure will remain on a homeowner's credit report for seven years, making it difficult to qualify for future loans or credit cards. It's important for homeowners to be aware of the long-term consequences of foreclosure and to take steps to rebuild their credit after the foreclosure process is complete.

When to Seek Professional Help

If you are facing foreclosure, it's important to seek professional help as soon as possible. A housing counselor or financial advisor can provide valuable guidance and resources to help you navigate the foreclosure process and explore your options for avoiding foreclosure. They can also help you understand your rights as a homeowner and advocate on your behalf with your lender.

Final Thoughts

Facing foreclosure can be a challenging and stressful experience for homeowners. However, by understanding the foreclosure process, exploring your options for avoiding foreclosure, and seeking professional help when needed, you can navigate this difficult time with confidence. Remember that there are resources available to help you through this process, and that there is light at the end of the tunnel. With determination and perseverance, you can overcome foreclosure and move forward towards a brighter financial future.