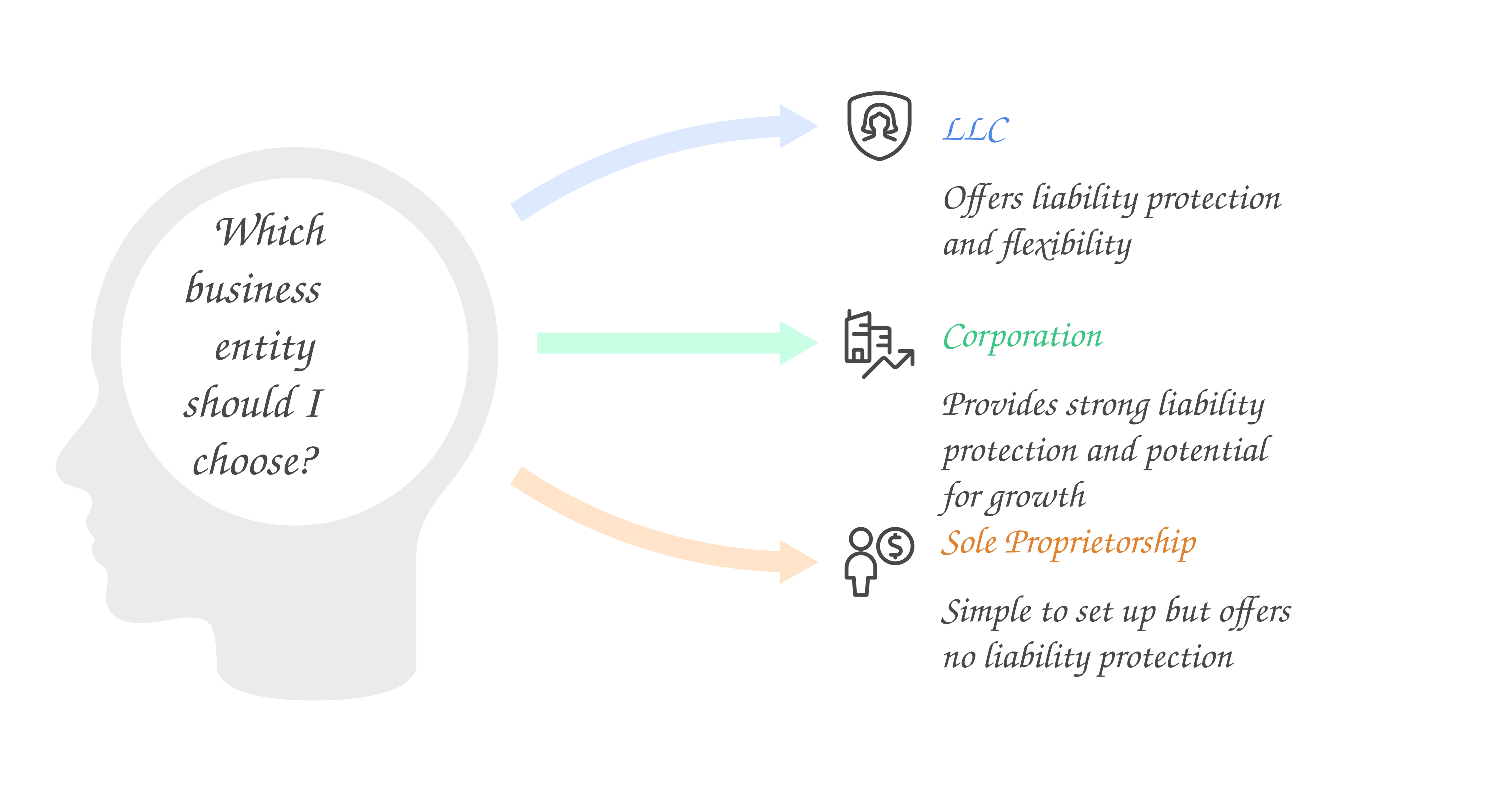

Choosing the right business structure is one of the most important decisions for any U.S. entrepreneur. The structure you form determines how well your personal assets—your home, savings, and investments—are protected from business lawsuits, debts, and legal claims. AdviceOnLaw helps business owners understand how different corporate structures can limit risk and provide long-term security.

🔒 What Is Liability Protection?

Liability protection creates a legal separation between you and your business. This means if the company is sued or goes into debt, your personal assets stay safe—as long as the business is properly structured and compliant.

🏢 U.S. Business Structures That Offer Liability Protection

1. LLC (Limited Liability Company)

A popular choice for small and medium businesses.

✔ Protects owners from business lawsuits and debts

✔ Simple and flexible

✔ Pass-through taxation

2. S-Corporation (S-Corp)

An LLC or corporation can elect this status.

✔ Liability protection similar to an LLC

✔ Avoids double taxation

✔ Good for growing small businesses

3. C-Corporation (C-Corp)

Ideal for larger companies and startups seeking investors.

✔ Strongest liability protection

✔ Complete separation of personal and business assets

✔ Attractive for shareholders and venture capital

4. LLP & LP (Partnership Structures)

Designed for professionals and investment groups.

✔ LLPs protect all partners from liability

✔ LPs protect limited partners but not general partners

⚠️ Structures That Do Not Protect You

- Sole Proprietorship

- General Partnership

Owners are personally responsible for all debts and lawsuits.

🛡 How Liability Protection Works in Real Life

- If a customer sues your business → your personal assets stay safe (LLC/Corp).

- If your business breaks a contract → only business funds are at risk.

- If the company goes bankrupt → you lose only what you invested, not your personal wealth.

💼 How AdviceOnLaw Helps

AdviceOnLaw guides business owners by:

- Explaining the best structure for your goals

- Helping you maintain legal compliance

- Providing resources on formation, taxation, and liability

- Connecting you with trusted legal professionals

Conclusion

The right corporate structure is your first line of defense against financial and legal risk. With expert insights from AdviceOnLaw, entrepreneurs can confidently choose a formation that protects their assets, supports growth, and ensures long-term stability.